Regulation of exports to the Netherlands has a background that is closely related to the history of trade, European Union regulations, and the role of the Netherlands as a global trade center. The Netherlands, which is a Western European country, has long been a strategic international trade center. Over the centuries, the Netherlands has built sophisticated logistics infrastructure, such as the Port of Rotterdam which is one of the largest in the world. This allows the Netherlands to become a gateway to the vast European market.

As the Netherlands entered the European Union (EU), export regulations to the Netherlands became increasingly integrated with EU regulations. As a member of the EU, the Netherlands follows the same policies and regulations that govern trade between EU members. This includes regulations on import duty rates, Value Added Tax (VAT), product safety standards, and so on.

The Netherlands also operates regulations specifically relating to exports, such as export permits for certain goods that may have an impact on national security or the environment. This country has special inspection bodies, such as the Dutch Customs Agency, which is responsible for supervising imports and exports.

Thus, export regulations to the Netherlands are the result of a long history of trade, membership in the European Union, and the Netherlands' role as a global trade center. A good understanding of these regulations is important for companies wishing to export to these diverse markets.

Why the Netherlands is an attractive export market ?

The Netherlands is an attractive export market for many international businesses for a number of key reasons:

- Access to European Markets

The Netherlands is located in the center of Europe and has excellent access to the wider European market. This makes it a gateway for companies looking to sell their products throughout the European Union, which is the world's largest single market.

- Superior Logistics Infrastructure

The Netherlands has an excellent logistics infrastructure, including modern ports (such as the Port of Rotterdam, one of the largest in the world), international airports, an efficient motorway network, and a good public transportation system. This makes it easier to send goods across Europe and the world.

- Ease of Doing Business

The Netherlands is known to have a conducive business climate. Its high ease of doing business ranking, transparent regulations, competitive taxes, and government and institutional support for business make it an attractive place for foreign companies.

- Position as a Global Logistics Hub

The Netherlands is a global logistics hub, which means that large logistics companies, distributors and providers of logistics-related services are based here. This allows export companies to utilize efficient distribution networks.

- Ease of Communication

Most Dutch residents speak English well, and the country has a culture that is open to cultural and linguistic diversity. This makes it easier for international businesses to communicate with local partners and customers.

- Economic and Legal Stability

The Netherlands is known for its economic and legal stability. This provides certainty to foreign companies wishing to invest and do business in the country.

All these factors, together with its strategic location in Europe, make the Netherlands an attractive export market for many international companies.

How is the development of Indonesian exports to the Netherlands ?

The Netherlands is also the 11th largest export destination country for Indonesia, with main commodities (based on HS4) including: palm oil (19.16%), copra (11.31%), monocarboxylic fatty acids (10.69%), unsaturated acyclic monocarboxylic acid (5.97%), tin (5.41%). Meanwhile, Indonesia's imported commodities from the Netherlands, namely: distilled coal tar (25.17%), goods transport vehicles (7.10%), petroleum (4.39%), artificial tow thread (2.64%), foodstuffs (2.12%).

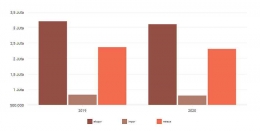

Trade with the Netherlands, Indonesia has a surplus of US$3.79 billion in 2021. According to a report from the Ministry of Trade (Kemendag), Indonesia's trade balance with the Netherlands recorded a surplus of US$3.79 billion throughout 2021.

This surplus grew 63.92% compared to the previous year, and was the highest achievement in the last 6 years. The total value of Indonesia's trade with the Netherlands also grew 39.81% from US$3.92 billion in 2020 to US$5.48 billion in 2021.

In detail, the value of Indonesia's exports to the Netherlands grew 48.75% to US$4.63 billion in 2021 compared to the previous year. Meanwhile, the value of Indonesia's imports from the Land of Windmills rose 5.2% to US$846.12 million in 2021.

Trade Balance between Indonesia and the Netherlands in 2020

Indonesia's trade balance with the Netherlands experienced a surplus of US$ 2.31 billion in 2020. However, the trade balance surplus figure appears to have decreased by 2.67% compared to the previous year's balance which was recorded at US$ 2.37 billion.

According to Trademap data, the decline in the trade balance is supported by the value of Indonesia's exports which was able to reach US$ 3.11 billion. This value is higher than Indonesia's import activities from the Netherlands which were recorded at US$ 804.33 million. Indonesia's export activities to the Netherlands have been on a downward trend in the last year. The previous year, Indonesia's export value was US$ 3.2 billion. As for imports, according to Trademap data there was a decrease of 3.33% compared to the previous year which was recorded at US$ 832.01 million.

Based on product type, there are 10 main products that Indonesia exports to the Netherlands which have proven capable of recording a surplus during 2020. The total export value of these main products reached US$ 2.17 billion.

Globally, the trade balance for all goods products is better this time because there has been an increase in several types of goods. The total value of Indonesia's trade balance was recorded at US$ 21.68 billion or an increase of 703.56%. In other words, Indonesia recorded a trade balance surplus. The previous year, Indonesia's trade balance with all countries in the world was recorded at US$ -3.59 billion.

Project Exported to Netherlands

List of 10 main products exported by Indonesia to the Netherlands

1. Vegetable fats and oils or oils and their breakdown products; Edible fats; Animals.

2. Other Chemical Products

3. Organic chemicals

4. Residues and waste from the food industry; Prepared animal feed

5. Wood and wooden goods; wood charcoal

6. Tin and its articles

7. Footwear, foot protectors and the like; part of such articles

8. Rubber and its articles

9. Cocoa and cocoa preparation

10. Furniture; beds, mattresses, mattress supports, pillows and similar doll furniture.

Why is it important to understand Export Regulations?

A good understanding of export regulations to the Netherlands is essential for many reasons:

- Legal Compliance

Understanding export regulations is a legal obligation. Violations of export regulations can result in sanctions, fines, and even serious legal consequences. Therefore, it is important to comply with the regulations to avoid legal problems.

- Export Facilitation

Understanding export regulations helps facilitate the export process. This can help you avoid bureaucratic obstacles that can hinder the flow of goods to the Netherlands and other European markets.

- Optimizing Costs

Understanding export regulations can help you optimize export costs. With good knowledge of customs duties, VAT and other trade regulations, you can avoid unnecessary additional costs.

- Reduced Risks

With a good understanding of export regulations, you can reduce business risks. You can avoid mistakes that could harm your company's reputation and reduce the risk of crises related to legal compliance.

- Unlock Opportunities

A good understanding of export regulations can also help you identify new trade opportunities and take advantage of them. This can help expand your business and reach a wider market.

- Building Strong Business Relationships

By complying with export regulations, you can build strong and mutually beneficial business relationships with your business partners in the Netherlands. Trust is a key element in international trade, and complying with regulations is an important step in building trust.

- Supports Long-Term Business Growth

Understanding export regulations is important for long-term business growth. This helps you ensure the continuity of your business in the Dutch market and reduces the risk of disruptions that could harm your business

- Increasing Competitiveness

In a competitive global trade environment, understanding export regulations can provide a competitive advantage. Companies that comply with regulations and understand the export process well can compete more effectively.

- Supports Company Reputation

Complying with export regulations can strengthen your company's reputation as an ethical and responsible player in international markets. This is important to maintain a positive image of your company.

Overall, understanding export regulations to the Netherlands is an important step in running a successful and sustainable international business. This helps protect your interests, reduce risks, and maximize opportunities in trade between countries.

Regulations that must be known when exporting to the Netherlands

Exporting to the Netherlands from outside the EU

The company is based outside the EU, and wants to start selling the company's products in the Dutch market. How to export products to the Netherlands? What do you need to take into account? This checklist provides practical information on taxes, Dutch and EU regulations, as well as some tips.

- Market research

When you want to export your product to the Netherlands, do market research to make sure there is a market. The Import Promotion Center from developing countries offers market information about European countries (you do not have to be from a developing country to use this information). There is also the European Commission's Access2Markets database.

- Find an agent or distributor in the Netherlands

Before you can start exporting your goods to the Netherlands, you must find a way to distribute the goods. There are a few options:

1. An agent

2. A distributor

3. Set up a branch in the Netherlands

To find the right partner to do business with, you can attend networking events, join business networks or conduct a search in the Dutch Business Register (in Dutch).

-Import levies

Please be aware that you have to pay various taxes when importing goods into the Netherlands:

1. Import duties

2. VAT

3. Excise duties, on tobacco and alcoholic beverages

4. Consumer taxes

These taxes are called import levies (invoerheffing). The amount to be paid in imported levies depends on the type of product and the country of origin. You can find this information in the European Commission's TARIC database. Although you usually don't have to pay to import levies yourself, your customer may find the amount of duties an impediment to purchase your products. Take the amount due in levies into account when setting a price, and determine if you want to market your goods on the EU market.

- Customs declaration

If you want to export products to the Netherlands from outside the EU, your representative inside the EU is usually responsible for lodging the customs declaration to officially turn the products from non-EU goods to Union goods. This is usually the importer, but in some cases you can be responsible: for example if you and your importer agree on the Incoterm Delivered Duty Paid. The importer will have to follow Dutch and EU rules and regulations as laid out in the articles Importing products into the Netherlands: regulations and Importing goods from a non-EU country.

- VAT

If you export goods to the Netherlands from a non-EU country, you will not have to charge VAT, unless you are also responsible for the import into the Netherlands. See also the EU pages on taxation and customs. There is also the possibility that you export your goods to a branch of your company in the Netherlands. In that case, whether or not your branch office has to charge and pay VAT depends on whether it sells the goods to other companies or to private individuals. See the Dutch Tax and Customs Administration information on the subject.

- Getting paid -- how to ensure you get your money

Especially if you work with an importer for the first time, you may want to make sure you will get paid for your products. There are several ways to increase that certainty, ranging from a letter of credit to advance payment. Also, it is of course common sense to check whether the party you are going to be doing business with is reliable and creditworthy. In the Netherlands, you can check the Dutch Business Register (Handelsregister) to find details on the company you are dealing with.

- Contracts

When setting up a collaboration with an agent or distributor, it is wise to document your agreement in a written contract. Make use of the ICC Incoterms. These are international standards for goods transport, to cover for instance:

1. Who arranges the transport from where to where

2. Who is responsible for transport insurance, licences, documents and cutoms procedures

3. At what point the transport liability transfers from seller to buyer.

-CE marking, labeling and other EU regulations

When preparing your product for the Dutch market, you have to take into account several product requirements: both Dutch and EU ones. There are regulations to be observed for:

1. Labelling

2. Product safety; these are laid down in the Commodities Act

3. CE marking or other product requirements; you can look these up in the EU Trade Helpdesk

4. When selling perishable goods: dating

5. Warranty

6. Providing documentation/manuals in the language of the country you're exporting to

7. Production methods (child labour etc.)

-Packaging and waste

The party importing your products to the Netherlands will have to contribute to the disposal of the packaging waste. Depending on the materials used, this contribution may be sizeable. Make sure you use an eco-friendly packaging material, if possible, and discuss packaging with your agent or supplier.

- Transport documents

When exporting goods to the Netherlands, you will have to provide several export documents to your national customs: an invoice, a packing list and a transport document. You may need additional documents if you export foodstuffs, plants or animals, or cultural or strategic goods, f.i. a certificate of origin, a licence or a health certificate. Your national chamber of commerce can help you find out which export documents you need to transport your goods to the Netherlands.