- Supports Company Reputation

Complying with export regulations can strengthen your company's reputation as an ethical and responsible player in international markets. This is important to maintain a positive image of your company.

Overall, understanding export regulations to the Netherlands is an important step in running a successful and sustainable international business. This helps protect your interests, reduce risks, and maximize opportunities in trade between countries.

Regulations that must be known when exporting to the Netherlands

Exporting to the Netherlands from outside the EU

The company is based outside the EU, and wants to start selling the company's products in the Dutch market. How to export products to the Netherlands? What do you need to take into account? This checklist provides practical information on taxes, Dutch and EU regulations, as well as some tips.

- Market research

When you want to export your product to the Netherlands, do market research to make sure there is a market. The Import Promotion Center from developing countries offers market information about European countries (you do not have to be from a developing country to use this information). There is also the European Commission's Access2Markets database.

- Find an agent or distributor in the Netherlands

Before you can start exporting your goods to the Netherlands, you must find a way to distribute the goods. There are a few options:

1. An agent

2. A distributor

3. Set up a branch in the Netherlands

To find the right partner to do business with, you can attend networking events, join business networks or conduct a search in the Dutch Business Register (in Dutch).

-Import levies

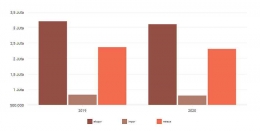

Please be aware that you have to pay various taxes when importing goods into the Netherlands:

1. Import duties

2. VAT

3. Excise duties, on tobacco and alcoholic beverages

4. Consumer taxes

These taxes are called import levies (invoerheffing). The amount to be paid in imported levies depends on the type of product and the country of origin. You can find this information in the European Commission's TARIC database. Although you usually don't have to pay to import levies yourself, your customer may find the amount of duties an impediment to purchase your products. Take the amount due in levies into account when setting a price, and determine if you want to market your goods on the EU market.