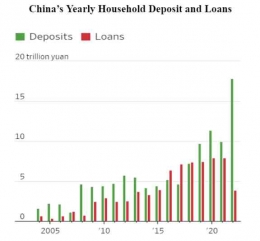

As long as there are still economic uncertainties, major purchases like real estate will take longer to recover. According to Li-Gang Liu, head of economic analysis at Citi Global Wealth Investments, the pandemic's aftermath may cause Chinese residents to change their saving behaviors in a manner similar to that of Americans who experienced the Great Depression. If consumption growth is less brisk than anticipated in the first and second quarters, this could lead to poorer GDP growth than planned, forcing economists to reevaluate their forecasts.

Chinese consumers have little confidence moving forward, in contrast to the American economy, which boomed throughout the pandemic. This is partially due to the fact that the Chinese government did not offer subsidies to its population, leaving many individuals without a support system. People might have understood the value of conserving more money as a result to protect their security.

A familiar foe: overcapacity

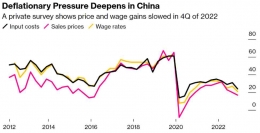

China's long-standing overcapacity issues may be another factor contributing to the country's deflationary pressure. The development of various factories and the growth of sectors like steel, coal, and cement are results of the nation's recent rapid economic growth. However, as demand for these products has slowed down, businesses are left with surplus capacity and are compelled to lower prices in order to remain competitive. Deflationary pressure is produced as a result, which might hinder economic growth.

Borrowing the impossible trinity concept

The Impossible Trinity actually refers to one of the most well-known theories in the study of economics -- specifically international economics and macroeconomics, according to which it is impossible for a nation to pursue all three options simultaneously: a fixed exchange rate, unrestricted capital flow, and independent monetary policy. During the peak implementation of the zero Covid policy in 2022, Chinese authorities faced an impossible trinity of their own. They cannot achieve "zero Covid", a synchronized monetary policy with the US Feds to maintain financial stability and 5.5% growth target at the same time (BBVA, 2022).

BBVA's research in 2022 shows that there are only two possible policy combinations given that the authorities were still committed to maintaining "zero COVID" policy: (i) if they want "Zero COVID" and a 5.5% growth target, they must implement aggressive monetary easing measures, which will cause capital flight and currency depreciation; or (ii) if they want "Zero COVID" and a synchronized monetary policy, they must accept a lower growth rate. In an easing policy environment, the central bank lowers rates to stimulate growth in the economy. Lower rates lead consumers to borrow more, also effectively increasing the money supply. Fast forward to today's situation, China has implemented monetary easing throughout 2022 to boost economic activities, especially with the deflationary risks lurking behind them. They have also suppressed their 5.5% growth target into a more feasible growth, currently being 4.5%.

Now, with the pandemic measures lifted, China could remove one variable from the three-way trilemma previously deducted -- which is the zero covid priority. However now, deflation and growth will be added to the mix. The renewed trilemma would be choosing between "giving up" monetary policy, "giving up" a fixed exchange rate, or restricting capital movement. Learning from Hong Kong's property crisis and its deflationary economy during the 1998 Asian financial crisis, China should make durable and necessary structural adjustments within the real economy.

China's answers: going forward?

While reports indicate that deflation might be coming to China, all of the speculations are based on the first-quarter economic reports, which does not necessarily translate into long-term deflation. Chinese senior economist, Jinyue Dong claimed that China is currently in the phase of an 'atypical' deflation cycle, which means deflation amid economic recovery. Some economic indicators reflected a solid economic recovery, such as the increasing manufacturing purchasing managers' index (PMI).

All in all, like Chinese senior economist Yu Yongding stated, the statement 'deflation has begun' is not necessarily accurate, but it is not a big mistake. Calling attention to deflation is entirely correct. Thus, the efficient Chinese government is already on the move -- they have held international meetings and vowed that they will increase their efforts to promote continuous improvement of the national economy, while prioritizing the recovery and expansion of consumption.