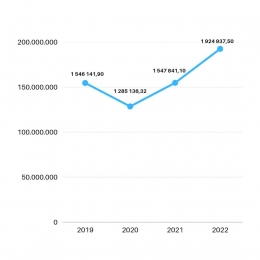

The data below shows that tax revenue has become one of the largest sources of income for the country in recent years.

According to the Directorate General of Taxes (DJP), in Indonesia alone, tax revenue reached an impressive amount of Rp688.15T in the first four months of 2023. This amount represents 40.05% of the 2023 State Budget target. Out of the total revenue, Rp522.7T was allocated to the central government's expenses. These funds were utilized for various programs that benefitted society.

Furthermore, tax revenue is used to reduce social inequality. Government programs like the Kartu Indonesia Pintar (KIP) and Kartu Indonesia Sehat (KIS) are concrete examples of how tax revenue is utilized to provide access to education and healthcare for the less fortunate. Additionally, measures such as increasing tax rates for the wealthy and reducing the tax burden for low-income groups are concrete efforts to reduce economic disparities.

Based on the data provided, it is evident how crucial the role of taxes is in maintaining economic stability in the country. Furthermore, the implementation of effective tax policies and rigorous oversight has increased tax compliance in Indonesia. This has had a positive impact on increasing state revenue and providing a solid foundation for economic stability.

We are currently entering the era of 5.0, where we face evolving global challenges. Because of this, we need to view tax revenue as a long-term investment for economic stability. Increasing tax revenue is not an easy task, but it is a crucial effort for achieving economic sustainability. Firstly, there needs to be an increased awareness of the importance of tax obligations for all citizens. This can be achieved through effective socialization, where tax officials can set examples of tax compliance, providing the public with a better understanding of the benefits derived from tax payments.

Furthermore, in building a strong economic stability, we need to ensure that tax revenue is not only used to finance infrastructure development but also to promote equitable prosperity and social justice. By establishing a fair taxation system and directing tax revenue to directly benefit the people, we can strengthen the foundations of strong economic stability.

Concrete steps are also needed to enhance tax compliance in all sectors. The government should engage the private sector and encourage transparent and responsible tax practices. Transparency is also key in building strong economic stability. The public should have easy and open access to information regarding the use of tax funds. This way, public trust in the taxation system can be increased, and they can directly witness how tax funds are utilized for public interests

Tax revenue is a key cornerstone in building a strong economic stability in Indonesia. With adequate tax revenue, the country can finance infrastructure development, strengthen fiscal policies, and provide adequate public services. However, to realize the full potential of tax revenue, collective awareness and concrete actions are required from the government, society, and private sector.

Let us collectively raise awareness about the importance of tax obligations and their benefits for our economic progress. By doing so, we can strengthen economic stability, create opportunities for inclusive growth, and build a brighter future for Indonesia. Tax revenue is not only the responsibility of the government but also the responsibility of all citizens. Let’s unite in building strong economic stability through sustainable and transparent tax revenue! Strong Taxes, Advanced Indonesia!

Reference

- Badan Pusat Statistik. (2022). Realisasi Pendapatan Negara. Retrieved June 20, 2023, from https://www.bps.go.id/indicator/13/1070/1/realisasi-pendapatan-negara.html

- Kemenkeu. (2023). Tumbuh Moderat, Penerimaan Pajak Capai Rp688,15 T per April 2023. Retrieved from https://www.kemenkeu.go.id/informasi-publik/publikasi/berita-utama/tumbuh-moderat-penerimaan-pajak-capai-688T

- Takumah, W. (2014). Tax Revenue and Economic Growth in Ghana: A Cointegration Approach. MPRA Paper No. 58532.