Auto LoansSubprime auto loans. When we hear the word subprime, things such as 2008 World Financial Crisis come up to our mind. Even Margot Robbie in The Big Short movie said that when you hear the word subprime, just consider it as a crap. Yes, in fact subprime is actually very harmful for US and world economy. In fact, no one can deny that subprime mortgage is the main cause of the 2008 World Financial Crisis.

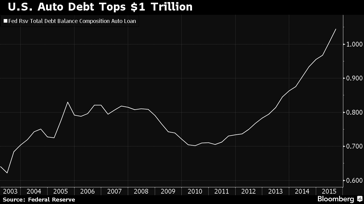

But, what about subprime auto loans? Subprime auto loan is a type of auto loan which allows people with poor credit rating (below 620 according to Fair, Isaac, and Company / FICO), or people that have poor financial ability to pay back their loans to perform an auto loan. This type of loan also carries an interest rate which is higher than the interest rate that is given to the prime borrowers, or people who have a good financial ability to pay back their loans to compensate the subprime borrowers’ higher probability of risk. Can this subprime auto loan really mess up The States’ economic system? When the numbers of car loans, including subprime car loans are increasing steadily, we should be concerned about it. The graph shown below, which The Fed released, shows us how auto loans are increasing, even exceeding $1 trillion at the end of 2015.

[caption caption="The Fed"]

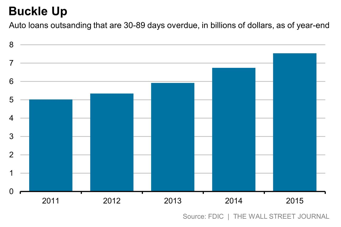

[caption caption="FDIC"]

Those two indicators above actually tell us that more and more Americans buy cars that they can’t afford, which is not a good thing for the economy. Since people are getting debt for goods that cost beyond their financial ability, and the goods itself depreciate from time to time. Even though lending these subprime auto loans are risky, creditors are so eager to perform this action to transform their payments into derivative product such as assets backed securities, which then are sold to investors who are always looking for products with high yields. The amount of subprime auto ABS (Asset Backed Securities) issuance already reaches a massive $27 billion issuance, according to Barclays.

Well, the volume of subprime auto loans aren’t as massive as the subprime mortgage was back in the days of the 2008 financial crisis, and the delinquency rate is not as massive as subprime mortgage back in the 2008 when it hits 35%. But, it still carries a dangerous risk. Indeed, the risk itself carries a different damage than we’ve ever seen before. In the housing crisis that we’ve been through before, the States’ unconventional monetary policy such as Quantitative Easing policy had been successful to increase and “light up” the property market which had been defaulted back at the time because people cannot pay their subprime mortgages. Compared to the property sector, cars are much more liquid as an asset, but the problem is, those cars cannot be QE-ed by the government, and if this subprime auto loans disaster occurred, those cars cannot be QE-ed by the Government. The next question is maybe if property could be QE-ed why couldn’t cars? The answer relies on the different nature of the two commodities. The nature of property is its value will increase overtime, but conversely, the nature of car is its value will surely be depreciated. Thus, the rising value of property after being QE-ed could turn losses into profits while cars will just be nothing but a cheap junk after they are being defaulted. Furthermore, if the cars were finally being defaulted, the cars would still belong to lenders and yet the have to bear with some amount of losses, because they need to cover between the initial value of the cars and the value after the cars are being depreciated.

Then, how can we overcome this problem? Well, some hedge funds already try to bet against the car loans market and hoping that this subprime auto loans could be the next “Big Short” in the future. But I think it’s not an appropriate thing to “hope” that this subprime car loans will happen in the future, since the impact could affect many people. Lot of Americans will lose their car and lenders also suffer a major amount of loss due to value that they must cover, if they’re able to cover up the value of that massive amount of debt like I’ve mentioned earlier. The US Government has to make a move as soon as possible. They need to regulate and create a policy that could control and tighten lenders in giving auto loans to people with poor credit ratings and they need to find a way to protect both lenders and borrowers, by creating a regulation that could prevent lenders to give auto loans to people with poor credit ratings, so they don’t have to cope with debt they cannot afford and lenders don’t have to face high risks that can mess them up, in order to prevent this subprime auto loans to become a disaster in the future. Especially to protect borrowers, who in reality have almost no chance to pay back their debts, and most of them are people who are lacking of productivity, or in other words, are unemployed. Which means they are financially vulnerable and more likely also be the victim if this subprime auto loans disaster occurs in the future. Like one of the line in the “Big Short” movie which says that the one that suffer the most in the crisis is not the white collar people, but poor people & immigrants who lose their goods and job.

By: Jascha Santoso | Ilmu Ekonomi 2015 | Staf Kajian Kanopi 2016

Sources :