The independence of central bank is something that most of us take as a given. There is no doubt that politics cannot be trusted to steer monetary policymaking. But can we then place our complete trust in central bankers? As we know, most central banks are given the freedom to make monetary policy at their discretion. However, some doubts have arisen, not least in the United States. In 2015, the Congress passed the Federal Oversight Reform and Modernization Act, which demands the Fed to be bound by an explicit rule when setting monetary policy.[1] This bill has reignited debate on whether monetary policy should be discretionary or rule-based.

Proponents of strict policy rules believe that central banks have oftentimes failed to do the right thing. They point to the growing frequency of financial crises and economic slowdowns in recent times, where the Fed's monetary policymaking has become more discreet. They provide reasons that deserve some merit.

First, that discretion is prone to produce unsound policies, due to the imperfection of human judgment. The economy, along with the multitude of intertwining factors affecting it, may simply be too complex for anyone to grasp completely. Without the strict guidance of a policy, central bankers might be clouded by personal bias in their judgment, or on a more conspiratorial tone, they might even be influenced by political interests.

Second, that discretion leads to time-inconsistency problem. Time-inconsistency problem is when the central bank announces that it is enacting a certain policy, but the reaction of economic actors towards this announcement triggers change to the situation and makes the central bank reconsider its policy. If the policymaking is discretionary, the central bank would be free to change their policy to suit the new situation, but this might be harmful in the longer term. Furthermore, continuous inconsistency discredits the central bank and creates an environment of uncertainty for economic actors. Certainty is necessary for businesses and households to make efficient economic decisions.[2]

The proposed solution to these problems is to impose strict rules on monetary policy. Currently many central banks, including in Indonesia, already set inflation target range. But with the exception of some central banks, such as New Zealand's, they are not legally obliged to follow these targets.[3] The Fed has also ever set a 6.5% unemployment rate goal but it discretionally abandoned it in December 2012.[4] Basing monetary policy on inflation and unemployment alone is criticized to be too simplistic.

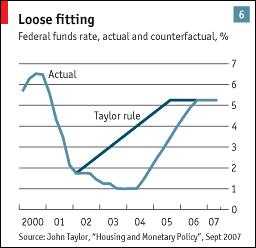

More recently, the Taylor Rule has surfaced as the better formula for setting interest rates. The Taylor Rule is a formula essentially stating that the real interest rate should be 1.5 times the inflation rate relative to 2%, or 1.5 times the economy's output rise relative to its potential.[5] This was formulated by John Taylor. Taylor did not come up with this formula on a whim, instead it was based on empirical observation of past trend in the Fed's monetary policy. So the Rule is not exactly a novel proposal on how to conduct monetary policy but a formulation of what the Fed has been doing, at least until recently.

Source: The Economist

Since the 2000s, the Fed's monetary policy is observered to have become more discreet, straying from the previous trend. Taylor believes that this deviation from trend, in which the Fed stayed too low for too long below the rate prescribed by the Taylor Rule (see graph), is what caused the 2008 financial crisis and its subsequent recessions.[6] Emboldened by these reasonings, Congress now wants the Fed to strictly follow the Taylor Rule or similar modifications of it. And if the Fed fails to do so, it must report to the Congress and subject itself to a full audit.

While rule-based policy ensures certainty and transparency, this proposal poses problems. The reason why central bankers don't always produce the best policy (although this is arguable) is because the economy is really complex. Rule-based monetary policy neglects this reality, in which the formulas proposed narrow down the scope of analysis by only involving a limited set of macroeconomic variables. For example, the input variables in the Taylor Rule are only the output gap and inflation rate, whereas monetary policy might also want to take into account currency valuation, stock market crashes, state of the labour market, financial market turbulence, the behavioral tendencies of economic actors and many more. In this aspect, discretionary policymaking is better as it does not restrain central bankers from considering a wider range of information.[7]

Another problem is that economic circumstances are simply too dynamic and unpredictable. Therefore, monetary policy should not be based on a set of rules that is predetermined with our limited understanding of the economy. Central bankers need to be flexible and innovative in fighting economic malaises. Furthermore, practical application of the Taylor Rule itself is prone to fatal mistakes. The measures of inflation, output and unemployment are unobservable in real time and difficult to measure with perfect accuracy. Even small errors in these measurements can drastically change the dependent variables. Last but not least, there is no solid consensus on which formula should be used for this rule-based policymaking. The Taylor Rule is not perfect and there exists several variations -- the inertial rule, forward-looking rule, first-difference rule, etc. -- each with their own strengths and shortcomings.[8]

So until we discover a magical formula that overcomes all these problems, central bankers should guard their discretion and resist government attempts to restrict monetary policymaking to rigid policy rules. Let the government set inflation targets or policy formulas as guidelines, but do not punish the central bank for considering other things. Alternatively, there could be legally binding rules; however, they should not be unilaterally decided by the executive government, but instead negotiated and agreed by both sides. This "contract" approach, adopted in New Zealand and Canada, is effectively the same because the central bank would never concede to a rigid policy rule anyway.

On the other hand, discretionary policymaking must be complemented by transparent communication, as well as credible commitment to maintain price stability, to control inflation expectations and minimize the time-inconsistency problem. For instance, Bank Indonesia releases monthly reports of the policies it implemented along with its justifications, while the European Central Bank holds press releases immediately after policy meetings. All this should be sufficient to strike an appropriate balance between rules and discretion, coined as "constrained discretion." At the end, this debate comes back to how competent and trustworthy our central bankers are. But for now, the Congress should back off.

Oleh I Gede Sthitaprajna Virananda | Ilmu Ekonomi 2016 | Staf Kajian Kanopi 2017

References

1https://www.congress.gov/bill/114th-congress/house-bill/3189

2http://gregmankiw.blogspot.co.id/2006/04/time-inconsistency.html

3http://www.investopedia.com/articles/forex/06/centralbanks.asp

Follow Instagram @kompasianacom juga Tiktok @kompasiana biar nggak ketinggalan event seru komunitas dan tips dapat cuan dari Kompasiana. Baca juga cerita inspiratif langsung dari smartphone kamu dengan bergabung di WhatsApp Channel Kompasiana di SINI