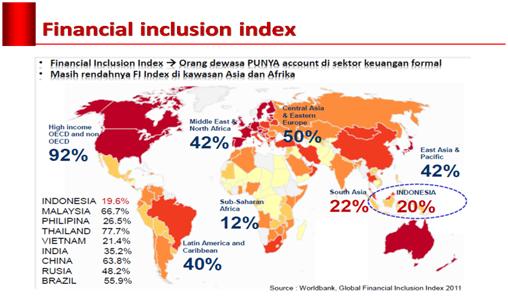

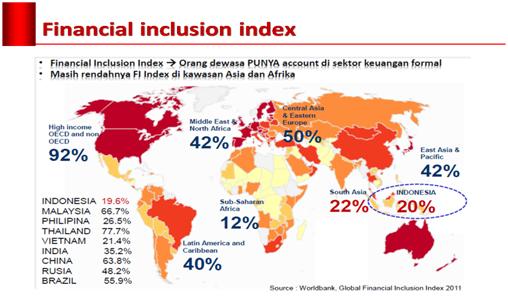

[caption caption="Financial Inlusion Index (doc: WB Global Financial Inclusion Index 2011)"][/caption]

Financial inclusion has been an important policy goal for quite some time. However, to date a sizeable majority of the population, especially the poor and vulnerable people still have no access to financial services. This is due to limited availability and accessibility of financial services.

Social benefits could be obtained if access to financial services could be improved. If the entire population have access to financial services, the government could distribute cash subsidies directly to the recipient's account. Therefore there are no long queues for the distribution of the cash subsidies would no longer occur. As a result, financial inclusion makes people, especially the poor, connected with economic opportunities. Thus it’s fostering economic growth and individual welfare.

This is just an example of how financial inclusion can benefit people who are currently not connected into the financial system. Hence, formidable tasks lie ahead.

The Challenge of Financial Inclusion

Financial inclusion defines as the right of every individual to have access to a full range of quality financial services in a timely, convenient, informed manner and at an affordable cost. So, in here financial services are provided to all segments of the society, with a particular attention to low income poor, productive poor, migrant workers and people living in remote areas. As a result, provide financial services and products need comprehensive financial inclusion strategy that are able to address all the different needs arising from different segments of the population and do so through a holistic set of services.

This strategy aims to address all layers of the population but with a clear understanding that different layers have different social and financial needs. However, it explicitly targets those groups with the greatest need or unmet demand for financial services and making sure that all key segments are taken into consideration. So, overcoming the barriers will create a fundamental breakthrough in simplifying access to financial services. In other word, Know Your Customers are needed for small value customers. All these things need to be done without compromising the principle of stability and prudent banking.

Therefore, the most important for the conceptual terms for inclusion should be. “Simplicity and reliability in financial inclusion, though not a cure all, can be a way of liberating the poor from dependence on public services. Further, the products should address their needs — a safe place to save, a reliable way to send and receive money.”

According to Global Index data 2014, there are 2 billion people that don’t use formal financial services and more than 50% of adults in the poorest households are unbanked. The reason for these is because of costs, travel distances and the often burdensome requirement involved in opening account. Therefore, financial inclusion is a key enabler to reducing poverty and boosting prosperity. As the World Bank President Kim has called for Universal Financial Access (UFA) by 2020.

In Indonesia the financial system is dominated by banks. The total of financial asset, banks manage 79 per cent as the World Bank Report in 2010. However most of the banks are present in densely populated areas, which are closely associated with the volume of economic activity that is in Java and more than 400 cities across Indonesia do not have bank branches. As a result, the banking sector is concentrated in and around Jakarta while low population and remote districts tend to be underserved.

Therefore there is a need for synergy to be developed between the strategy for increasing access of financial services and economic development programs, as well as, poverty reduction efforts. Taken together, the above findings underscore the importance of expanding financial service institutions abilities to offer both savings and credit services, while raising depositors’ incomes through broader policies of economic development. These findings also underscore the challenge for Indonesia’s formal financial system to expand its client base and to reach a much larger portion of the population.